🇺🇸 U.S MILLENNIALS STRUGGLING UP TO $10K IN CREDIT CARD DEBT:

New Step-By-Step Playbook Reveals

6 Proven Module Secrets To Erase Credit Card Debt In 6-12 Months Without Budget Burnout Or Side-Hustle Misery.

Learn How You Can Achieve Debt Freedom Quicker Without Debt Counsellors, Bank Repayment Plans, And TikTok Debt Advice.

Make sure your sound is turned on!

INTRODUCING:

A No-BS Realistic Debt Framework Playbook for building a 6–12 month Escape plan to finally Escape credit card debt without burning out on strict budgets, Risky side hustles, or Sacrificing Your Lifestyle Just For A Few Dollars.

BANKS HATE YOU FOR READING THIS PLAYBOOK.

SCROLL DOWN WHY:

There Are 2 Types Of Millennials Drowning In CREDIT CARD DEBT:

Those Who Keep Managing Debt Forever.

Those Who Finally Escaped Debt - For Good.

If you’re like most working millennials...

You’re probably sick and tired of:

❌ Watching your balance stay the same

no matter how hard you work.

❌ Paying hundreds in interest each month

for the privilege of being broke.

❌ Feeling guilty every time you buy

something small that keeps you sane.

❌ Trying every “debt-free app”

or “snowball plan”only to burn out.

❌ Wondering if you’ll ever breathe again

without that number hanging over you.

And the worst part? Every day you wait,

The bank quietly steals another $5 – $10 in interest from your account. That’s $150 a month gone just for existing inside their system.

You’re not bad with money. You’re fighting a game that was rigged against you from day one.

🇺🇸 AMERICAN MILLENNIALS STRUGGLING UP TO $10K IN CREDIT CARD DEBT:

New Step-By-Step Playbook Reveals

6 Proven Module Secrets To Erase

Credit Card Debt In 6-12 Months Without Budget Burnout Or Side-Hustle Misery.

Learn How You Can Achieve Debt Freedom Quicker Without Debt Counsellors,

Bank Repayment Plans, And TikTok Debt Advice.

Make sure your sound is turned on!

DEBT PAYOFF Strategies verified by real data:

THERE ARE TWO TYPES OF MILLENNIALS

DROWNING IN CREDIT CARD DEBT:

Those who keep managing debt forever.

Those who finally escaped debt - for good.

If you're like most millennials, you're probably sick and tired of:

Watching your balance stay the same no matter how hard you work

Paying hundreds of interest each month for the privilege of being broke

Feeling guilty every time you buy something small that keeps you sane

Trying every "debt-free app" or snowball plan only to burn out

Wondering if you'll ever breathe again without that number hanging over you

And the worst part?

Every day you wait, the bank steals another $5 - $10 in interest from your account. That's $150/pm gone - Just for EXISTING INSIDE THEIR SYSTEM.

You're not bad with money. You’re fighting a game that was rigged against you from day one.

BUT HERE'S THE GOOD NEWS

ABOUT YOUR DEBT SITUATION:

We’re living in the biggest debt-freedom opportunity window in modern history.

Why? Because the same technology that the banks use to predict your spending habits can now be used by you to outsmart their profit model.

2025 credit-card rates: 24 %+ — the highest in 20 years.

45 million American millennials carry card balances averaging $6K – $10K.

But new automation tools and negotiation scripts make it possible to flip the equation and start shrinking your debt every month without changing your lifestyle.

Most millennials are still doing it the hard way — budgeting harder, saving less, and hoping for a miracle. Those who learn this new system are buying back their freedom a year at a time. This window won’t stay open forever. But the longer you wait, the more you pay to stay stuck.

A No-BS Realistic Debt Framework Playbook for building a 6–12 month Escape plan to finally Escape credit card debt without burning out on strict budgets, Risky side hustles, or Sacrificing Your Lifestyle Just For A Few Dollars.

PLUS: You'll Also Get +4 Bonuses For FREE:

BONUS #1: The 72-Hour Debt Control Manual: Your emergency debt-control system for financial chaos and sudden income drops, built to stabilize your finances fast.

BONUS #2: The Shame-To-Stability Shift™ Guide: your emotional reset guide to break the guilt-shame cycle and finally feel calm, clear, and in control of your money.

BONUS #3: Spending Triggers Workbook™: A focused behavioral tool that helps you spot and reprogram emotional spending habits before they spiral.

BONUS #4: NeuroReset Audio Soundscapes™: 3 hours of therapeutic soundscapes that flip you from stress to clarity mode so you can make better money decisions with a clear head.

$275 Worth Of Debt-Freedom Tools

Yours For Just $37 Today! (-85%)

You're Saving $238 Today.

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

But Here's The Good News About Your Debt Situation:

We’re living in the biggest debt-freedom opportunity window in modern history.

Why? Because the same technology that the banks use to predict your spending habits can now be used by you to outsmart their profit model.

⚠️ 2025 credit-card rates: 24%+

— the highest in 20 years.

⚠️ 45 million millennials

carry card balances averaging $6K – $10K.

✅ But new automation tools and negotiation scripts

make it possible to flip the equation and start shrinking your debt every month without changing your lifestyle.

Most people are still doing it the hard way — budgeting harder, saving less, and hoping for a miracle.

Those who learn this new system are buying back their freedom a year at a time. This window won’t stay open forever. But the longer you wait, the more you pay to stay stuck.

From The Desk of Matthew Williams

Founder of Debt Escape Secrets™

United States of America

2025

Dear millennial,

If you're working full-time, making decent money, but still drowning in credit card debt...

(Even if you've tried budgeting apps, BS side hustles, debt counsellors, "skip-starbucks" hacks or “repayment plans” your bank swears will help)...

This may be the Most Important Letter You Read ALL YEAR.

Here’s why:

My name is Matthew Williams.

I'm 36, working in Healthcare Administration with a $76,000 salary. (before taxes obviously)

7 years ago, I was drowning in $9,200 worth of credit card debt spread across 5 cards.

I wasn't spending recklessly on luxury dinners and designer crap...

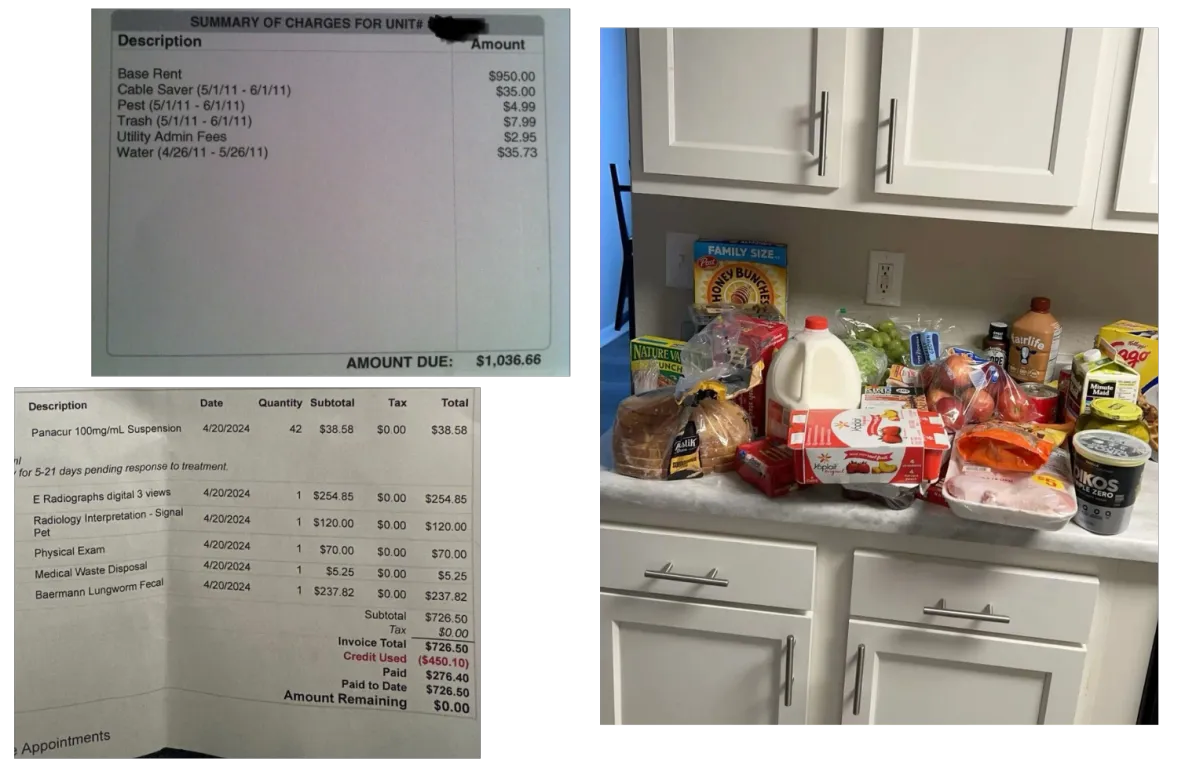

I was just living the normal life:

💰Groceries.

💰 Vet bills from my dog.

💰 Utility bills to keep the lights on.

💰 Maybe a couple beers with friends.

💰 And some shopping with my family.

Regular lifestyle right?

But every month?

💳 I'm paying $388 in minimums.

💳 Owing $1,700 a year in interest.

💳 And my balance barely moved.

The worst part? I thought I'm just bad with money.

That if I just made and save more, my debt would go away.

Guess What? "More Money"

Didn't Solve My Debt.

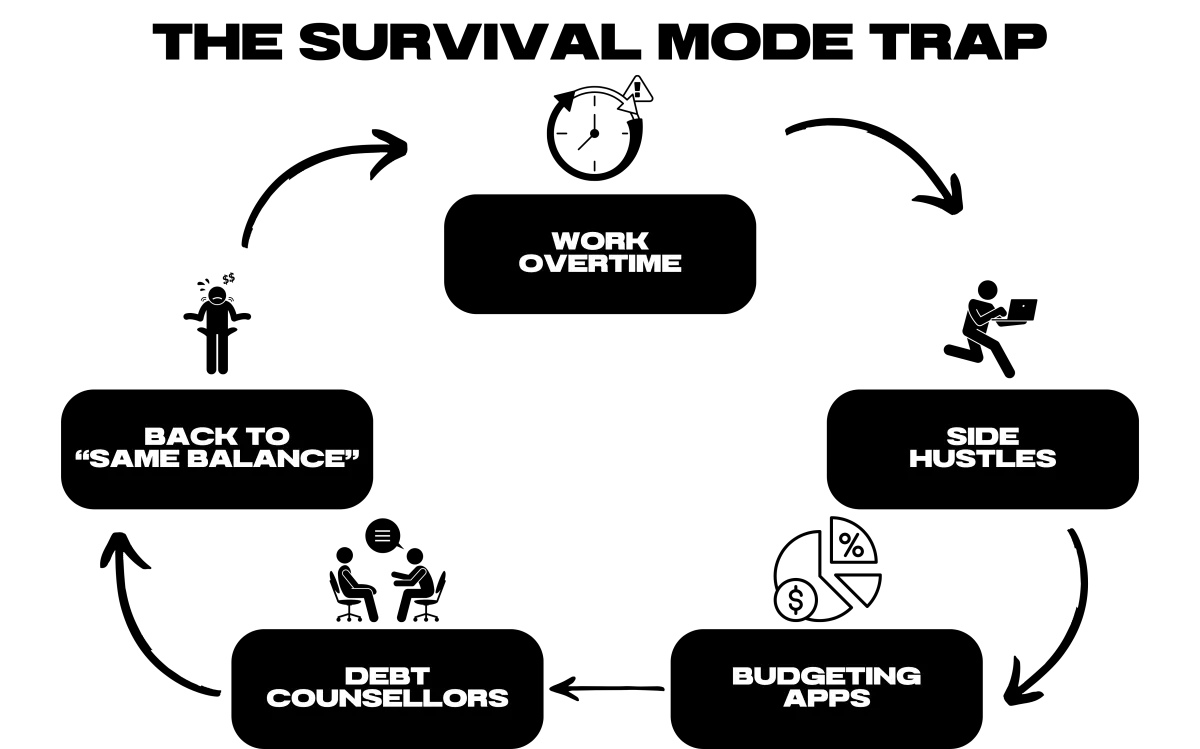

❌ I worked overtime just to miss my family for a check that barely covered bills.

❌ Chased DoorDash gigs and “financial freedom hustles” from BS gurus that drained my energy and wallet.

❌ Saved every dollar in spreadsheets just to live a frugal lifestyle and still be broke.

❌ I even sat with debt counsellors and looked at repayment schemes from my bank, but all they gave me was paperwork, promises, and months later… my balance still looked the same.

And while I was doing all that?

🏚️ Rent was swallowing nearly half my paycheck.

🛒 Groceries and gas ended up on my card just to keep life moving.

📱 I’d open my banking app, see the balance, and instantly feel sick.

📞 Unknown number calling? Panic it was a collector.

I was stuck in "SURVIVAL MODE", and barely made any progress with the payments.

It’s like the harder I sacrificed my time and energy...

The deeper I sank with head-pressuring stress and chest-tightening anxiety...

With the shame and guilt of not being able to truly provide for my family while pretending I was “financially fine” grabbing drinks with friends...

And the worst sting?

Watching friends save for weddings and down payments while I couldn’t even split a dinner bill without wondering which one of my cards still had room.

That weighed HEAVIER than my debt itself.

I Slowly Realised The Banks

Were Up To SOMETHING.

It was the same cycle every month:

🚩 Work Harder.

🚩 Pay more.

🚩 Sacrifice everything.

Yet, my debt balance never moved. Maybe it was my spending habits, or my discipline with money?

But then I looked closer:

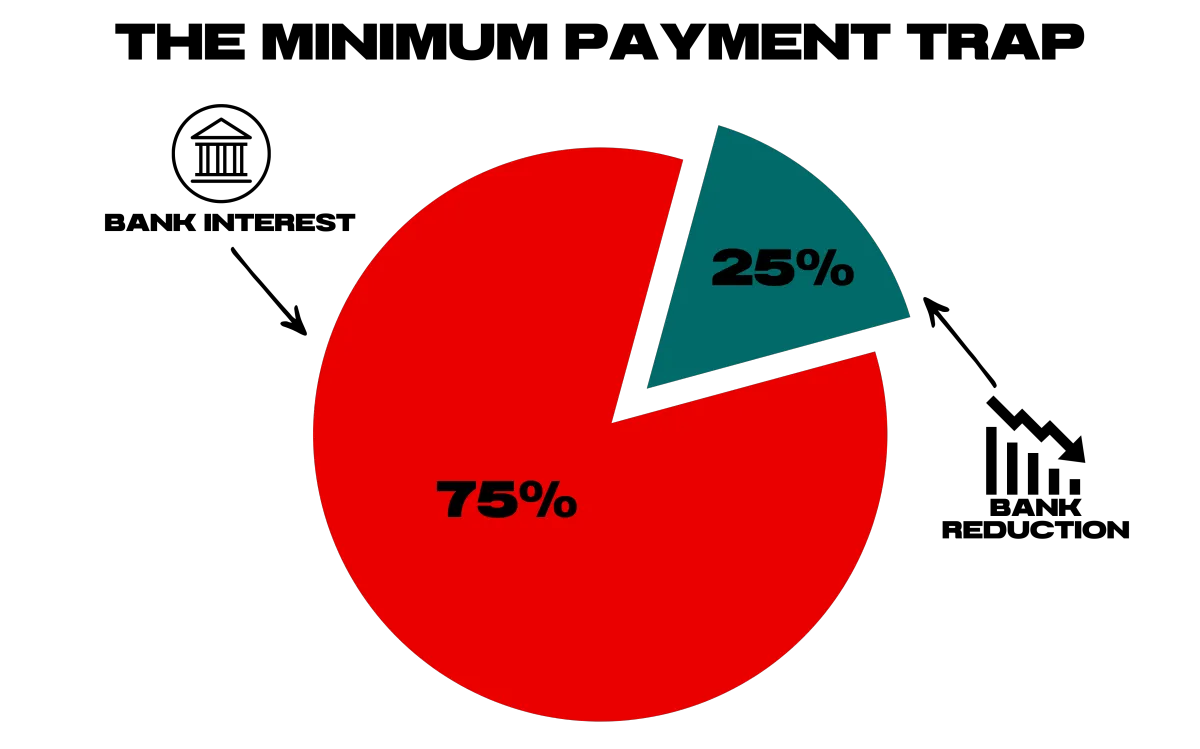

Every statement bolded "Minimum Payment Due" like it was my safety net.

But here's the trap:

The bank takes their interest cut first. (the fee they charge for letting me borrow.)

Because the minimum payment is set so low, almost nothing actually chips away at my real balance.

I was mostly just covering the BANK'S PROFIT instead of MY DEBT.

If I only kept paying the minimum?

👉 A $6,000 balance could take nearly 20 years to pay off.

👉 By the end, I’d have shelled out around $12,000 which is double what I borrowed.

That's not just numbers.

That's a down payment on a:

💸 Home.

💸 Wedding fund.

💸 Or years of peace of mind.

I finally saw the pattern:

❌ The problem wasn’t EFFORT.

✅ The system was built to keep me in debt AS LONG AS POSSIBLE.

Once I understood that, I started searching for a way out.

That’s when I discovered the loophole:

The Banks Were Built To

PROFIT from Your DEBT.

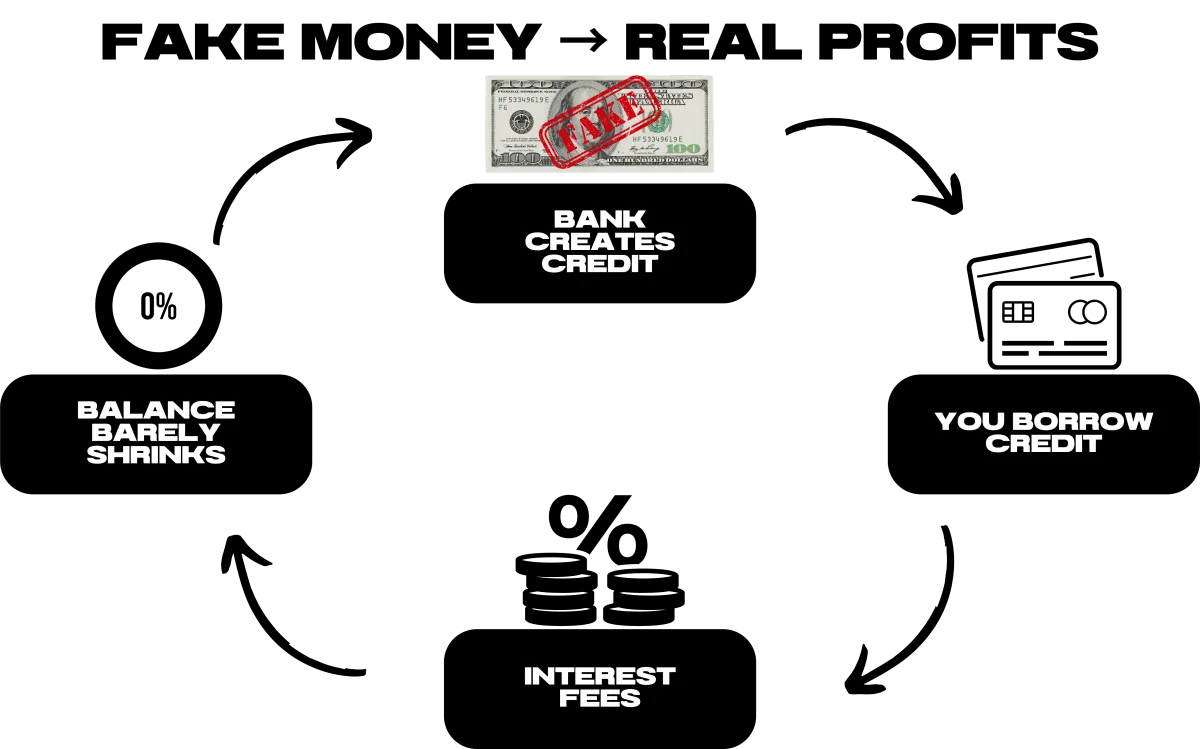

Think about it for a moment...

Have you once asked yourself how banks hand out billions in credit?

Yet they have the budget to build skyscrapers, and pay their employees really well?

If you think the government fund these banks, it might not be what you think it is...

Here's the truth about money they don't teach you in school:

👉 The government prints the paper.

👉 The Federal Reserve sets the rules.

👉 But the BANKS?

The money you borrowed from them? They were literally generated out of THIN AIR from their computers.

Banks Aren't The Only Ones TAKING YOUR MONEY.

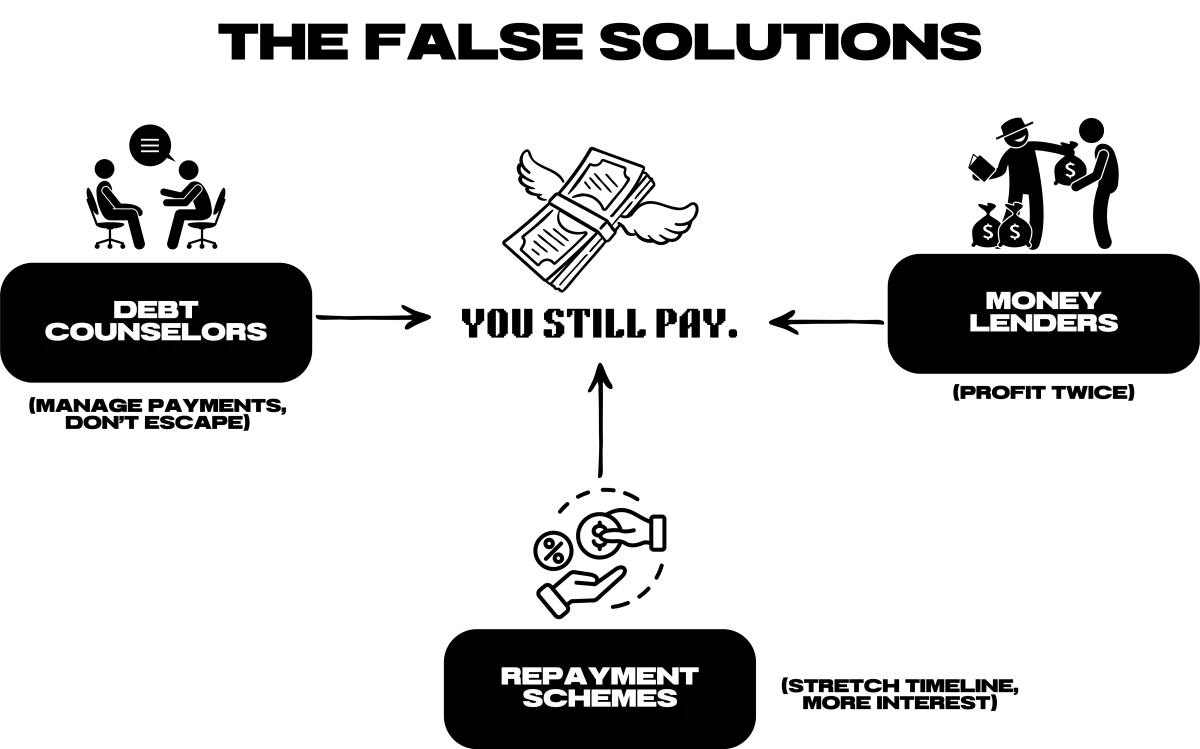

The “solutions” they dangle in front of you aren’t built to set you free either:

💸 Debt Counsellors? They’ll happily help you “manage” payments, but managing isn’t escaping. They keep you paying slow.

💸 Money Lenders? They profit twice: once when you borrow, again when you repay with interest. You’re just trading one master for another.

💸 Bank Repayment Schemes? They lower your monthly bill, but secretly stretch your timeline so you end up paying more interest overall.

They don’t cure the disease. They just rearrange the symptoms.

And the longer you stay in these loops, the more the system profits from your pain.

The Debt You've Gained Was NEVER YOUR FAULT.

I’m here to show you that the banks are trying to keep you in pain...

By sugarcoating the “comfort” of instant cash that ISN’T EVEN REAL.

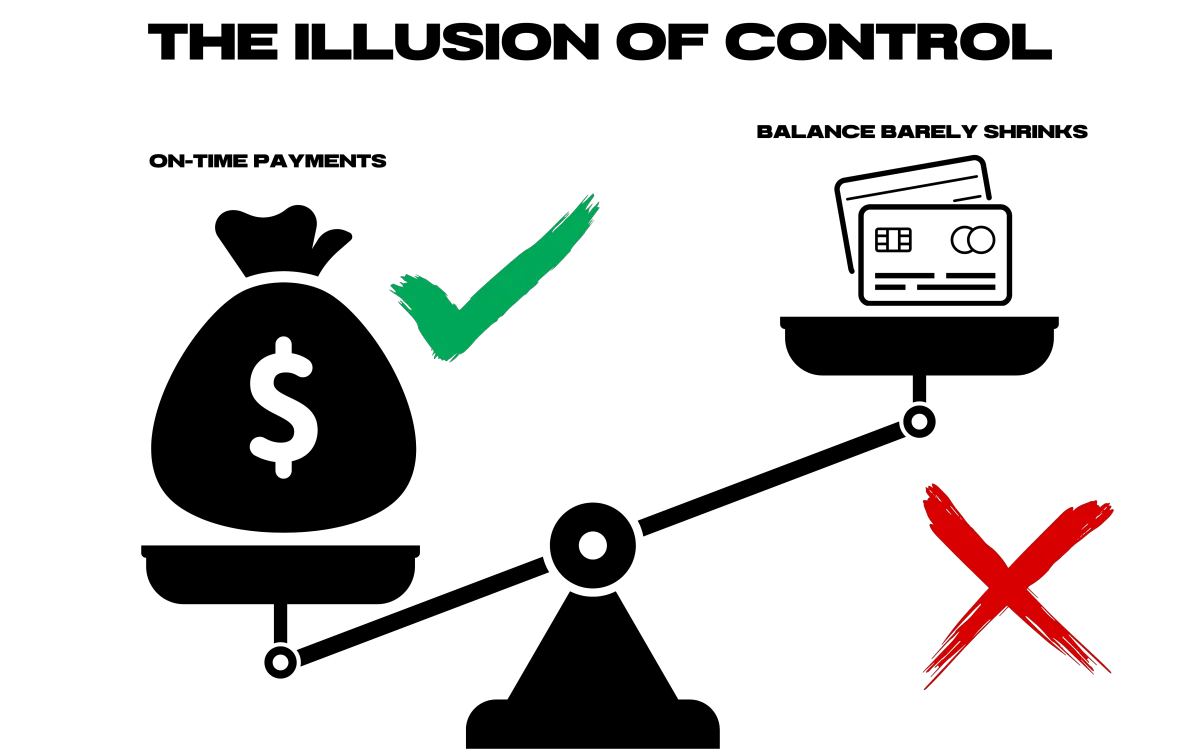

👉 This is the ILLUSION OF CONTROL:

✔️ You’re applauded for “on-time payments” while your balance barely shrinks.

✔️ You’re told to “build credit” by keeping accounts open...

But those same accounts are draining YOUR WEALTH.

I Had To Build A

Debt Escape System FAST.

The truth was, I started with traditional advice first.

👉 Downloaded the budget apps

👉 Built 12 different spreadsheets

👉 Saving 20% of my monthly income

Guess what? They didn't work.

BECAUSE HERE'S THE PROBLEM:

🚫 Budgeting Apps? They rearranged the pain but never fixed the interest bleeding me dry.

🚫 Side Hustles? Yeah, I made extra cash. But it disappeared right back into the cycle because of mental fatigue.

🚫 Old-School Advice? That was our parent's time where wages were higher, tuition was cheaper, and groceries didn't cost double.

No wonder I was stuck.

So I built my own debt escape system that's aligned for my lifestyle while running it on autopilot so I can focus on the important tasks of my life.

it took me 19 months of pain to figure this out, but the results started stacking up.

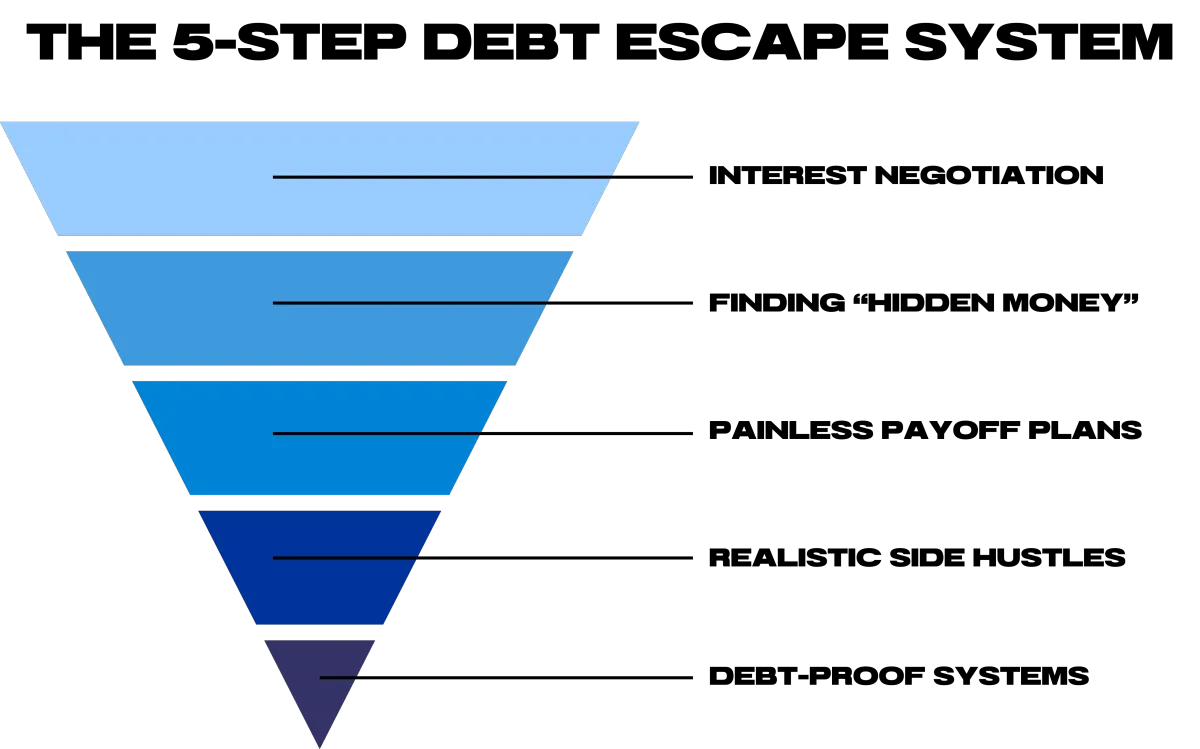

1. Interest Negotiation

☎️ The first breakthrough came when I learned how to negotiate with my lenders.

With just a few specific phrases, I shaved off interest rates and saved hundreds.

(That one call felt like I was finally stealing power back from the banks.)

2. Finding "Hidden Money"

I discovered a way to free up extra cash every month without sacrificing my lifestyle.

❌ I didn’t cancel Netflix.

❌ I didn’t give up $10 lattes.

Instead, I found and plugged tiny “money leaks” that added up to hundreds more in my pocket every month.

3. Painless Payoff Plans

🥶 Next, I froze two of my cards and started attacking them one at a time.

🥊 That shift alone turned “random payments” into a plan that actually crushed balances.

4. Realistic Side Hustles

💵 On top of that, I found side hustles that actually worked.

Not the BS guru stuff, but quick wins that gave me breathing room to hit my balances harder.

4. Debt-Proof Systems

🔧 And finally, I built habits to make sure I’d never fall back.

Systems that locked me in, even when life threw curveballs.

The Results?

💳 I paid off $9,200 across 5 cards in just 19 months.

💵 Saved over $4,000 in interest.

🛌 Slept debt-free for the first time in years.

IN SHORT, I'M ARMED WITH:

✅ Battle-tested strategies summed into 6 modules that helped me kill my balances faster.

✅ The exact words to slash interest and fight back against the banks.

✅ A way to free up hundreds every month without penny-pinching.

✅ Side hustles that actually worked. (not guru BS)

✅ Habits that made my debt freedom permanent.

No Overpromises.

Just Realistic Results.

"I’m a single mom with 2 kids. I used to stay up at night thinking how I was ever going to pay off my credit cards. Every month I paid something, but the balance barely moved. This system gave me an actual plan. I’m not debt-free yet, but for the first time, I finally see the number going down, and I can breathe again."

"I was almost $15,000 in debt. I stopped checking my statements because it made me sick. This plan broke it down step-by-step. Now my balance is finally dropping every month, and I don’t get that pit in my stomach anymore."

"I’ve tried budgeting apps, spreadsheets, everything. Nothing worked. This guide showed me why I was stuck. It wasn’t how much I earned, it was how I was paying. I started applying the system and within a few weeks, I saw my balances start to shrink. Simple. Finally."

"I didn’t think this would work. I’ve tried paying more before, but nothing really changed. But this system wasn’t about throwing money at it, it’s how you schedule the payments. That small shift made all the difference."

"I always thought I needed to get a second job to kill my debt. Turns out, it wasn’t about earning more, it was about fixing how I paid. I’ve already shaved off $1,800 from my credit cards without adding extra income."

“I left college with about $9,000 in credit card debt and so much shame. I remember lying awake at night thinking I’d never crawl out. Every time I checked my balance, I felt sick. The playbook felt like a roadmap built for people my age. Now I’m finally making progress.

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

No Overpromises.

Just Realistic Results.

7-day Money-Back Guarantee

100% Secure 256-Bit Security Encryption

30-Day Money Back Guarantee

Privacy Protected

THE OLD WAY OF FIXING DEBT:

Wait for a cashflow crisis before taking control

Bank "repayment plans" that keep you paying longer

Follow budget apps that shame you for living a life

Grind side hustles for pennies and burnout

THE NEW WAY OF FIXING DEBT:

Negotiating interest fees through phone calls

Plug money leaks without sacrificing lifestyle

'Realistic' side-hustles pay off debt faster

Automated debt payoff systems to ease payoff journey

You're Not Behind In Life.

Reading This Already Saved You

20+ Years Of Payments.

If you've scrolled this far,

It shows that you're dedicated enough to get your debt fixed so you can have a fresh new restart in your finances.

So I broke everything down:

💳 Every breakthrough

💳 Every script

💳 Every strategy...

Into a Full-Stack Playbook designed specifically for millennials like you drowning in credit card debt:

Imagine waking tomorrow, opening your bank app, and seeing your balance finally dropping.

No panic and shame. Just PURE PROGRESS.

Inside, you’ll discover 6 modules.

Each one packed with the exact moves I used to wipe out my $9,200 of debt without budgeting apps, side-hustle burnout, or self-shame.

This isn’t theory, or some generic budgeting Playbook.

This is the playbook I wish I had 7 years ago.

7-Day Money-Back Guarantee

100% Secure 256-Bit Security Encryption

THE PLAYBOOK MODULES:

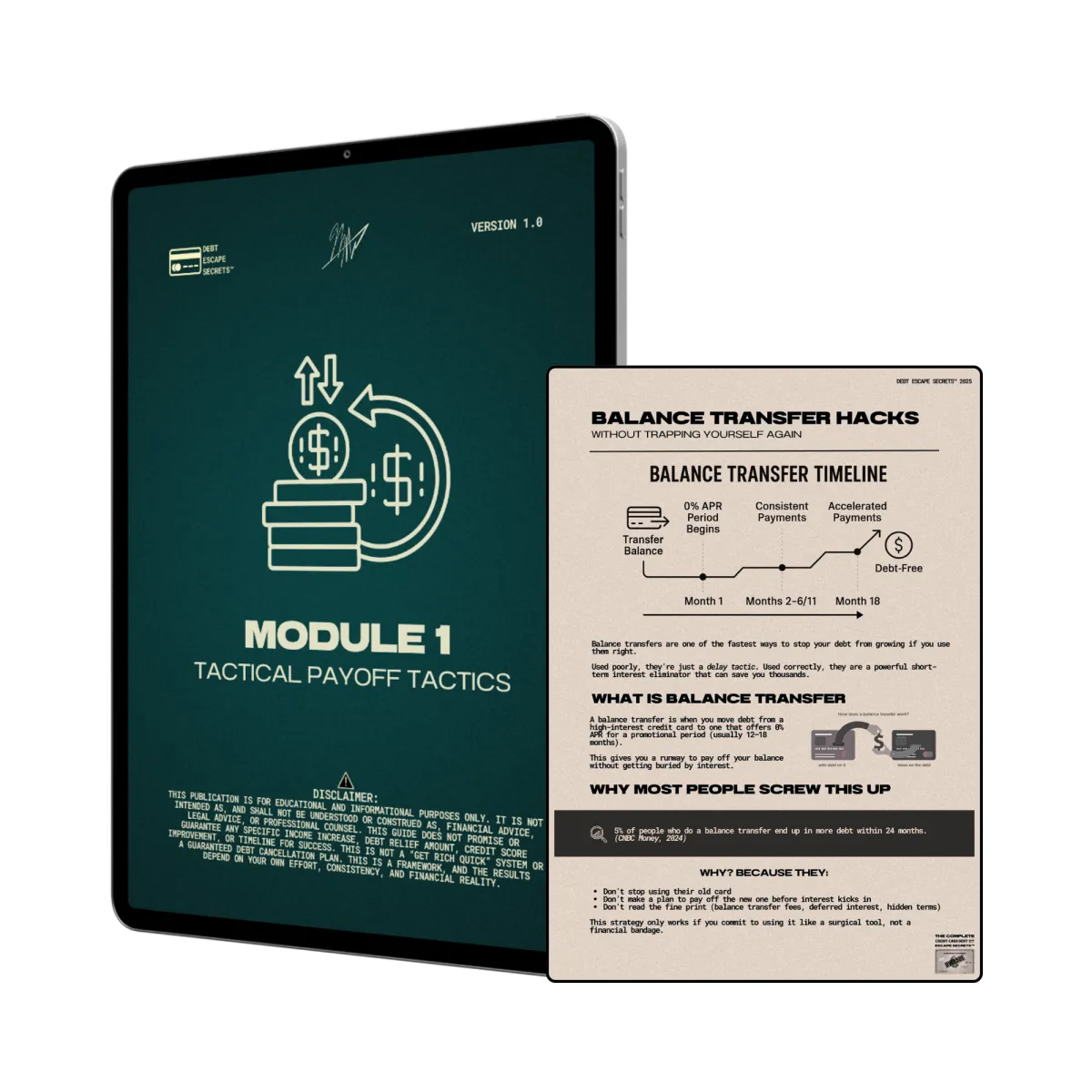

MODULE 1:

Tactical Payoff Tactics

You immediately understand why your past payoff attempts failed and finally see the clear path to making real movement on your balances.

You replace outdated, shame-based advice with practical tactics that actually reduce interest and accelerate momentum.

You feel the psychological shift of seeing your debt go down instead of staying stuck — giving you the confidence to keep going.

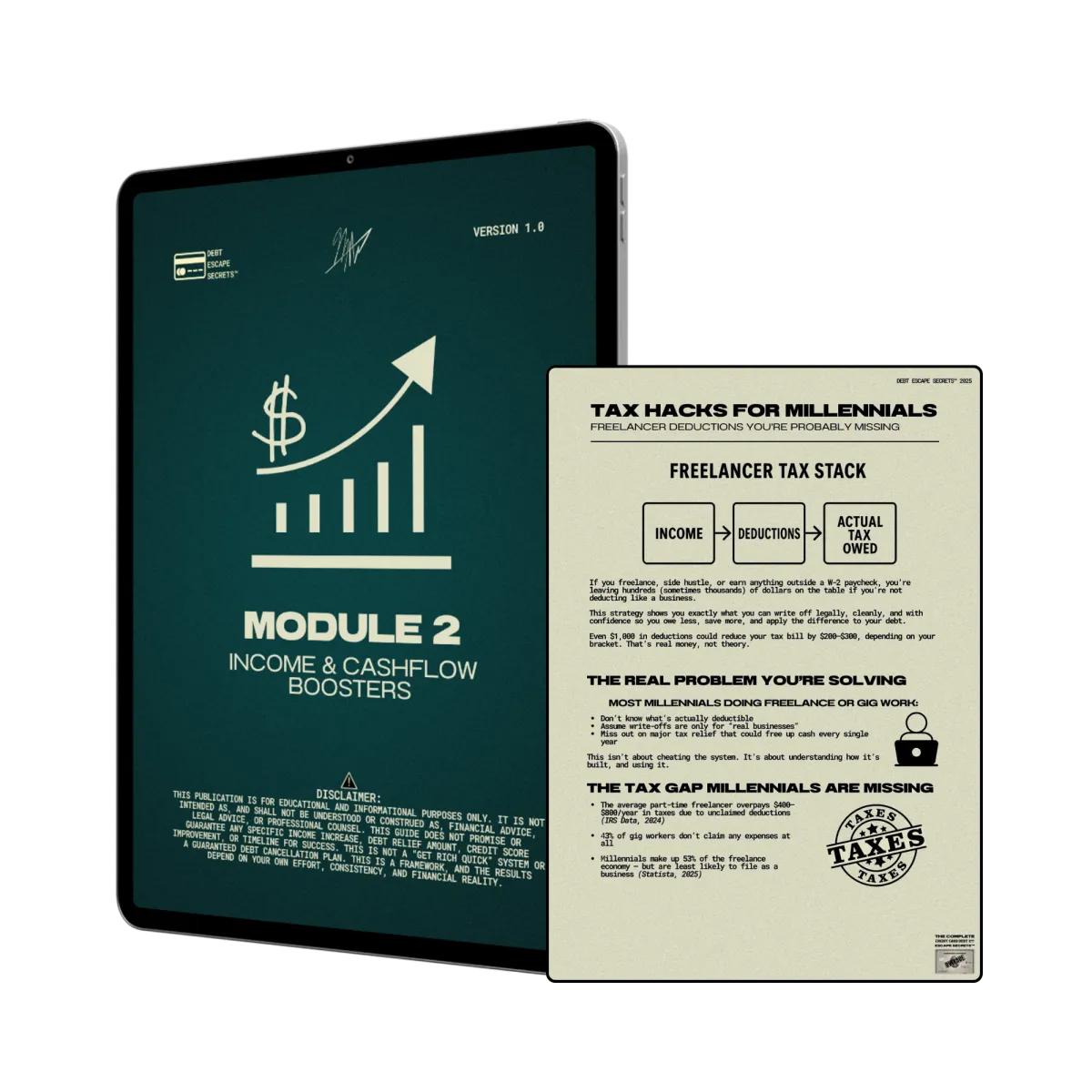

MODULE 2:

Income & Cashflow Boosters

You start generating extra monthly breathing room without needing a raise, a side hustle grind, or extreme lifestyle cuts.

You discover hidden cash leaks and silent drains you didn’t realize were holding you back — and reclaim money within days.

You finally feel relief from the paycheck-to-paycheck pressure because your cashflow becomes predictable, stable, and lighter to manage.

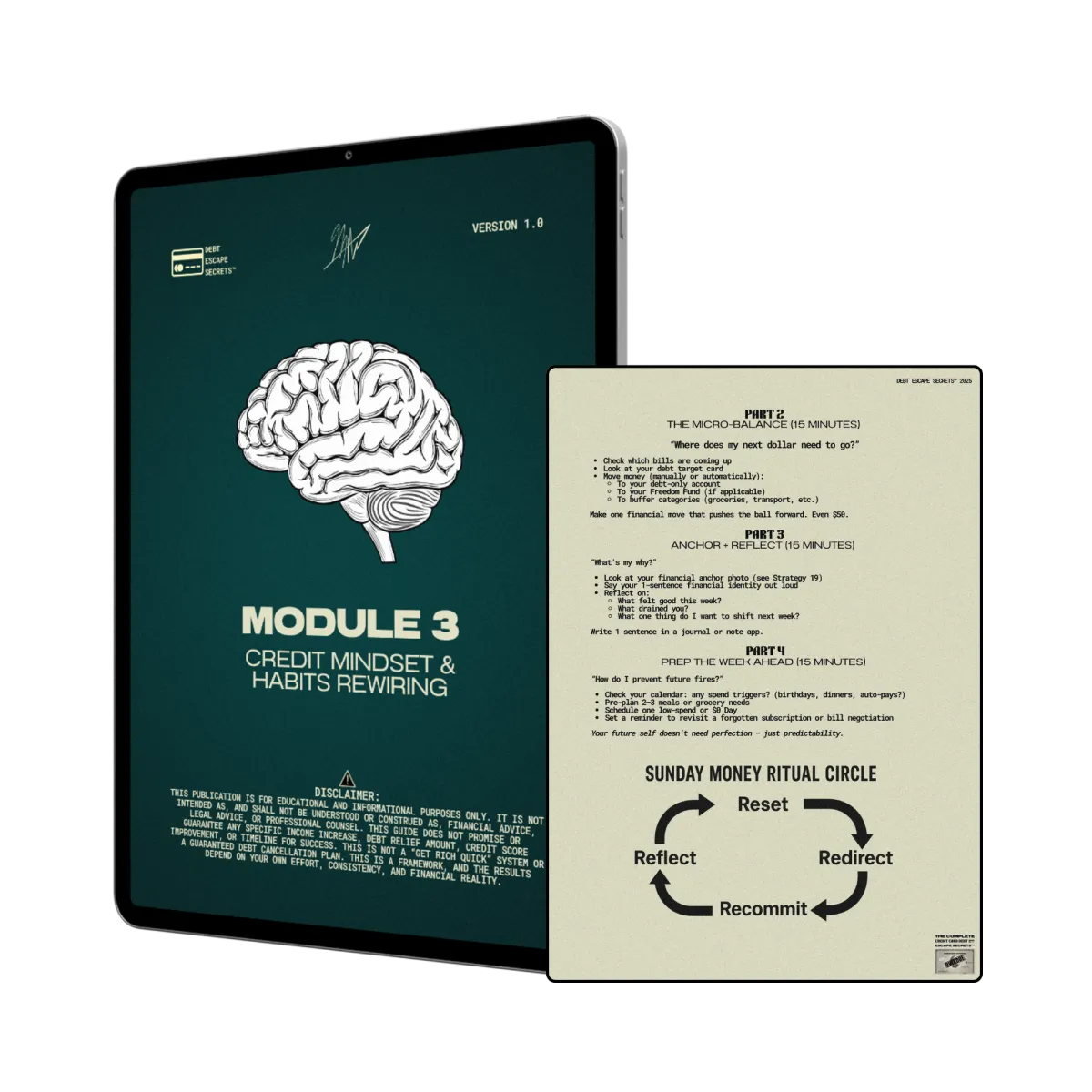

MODULE 3:

Credit Mindset & Habits Rewiring

This resets the mental loops that drain your motivation — the overthinking, avoidance, and shame — so you can finally follow a plan without mentally collapsing halfway through.

You’ll replace discipline-heavy habits with systems that run in the background and keep you consistent even on stressful, low-energy days.

You stop feeling like you’re “bad with money” and start feeling in control again, because your habits begin working for you instead of against you.

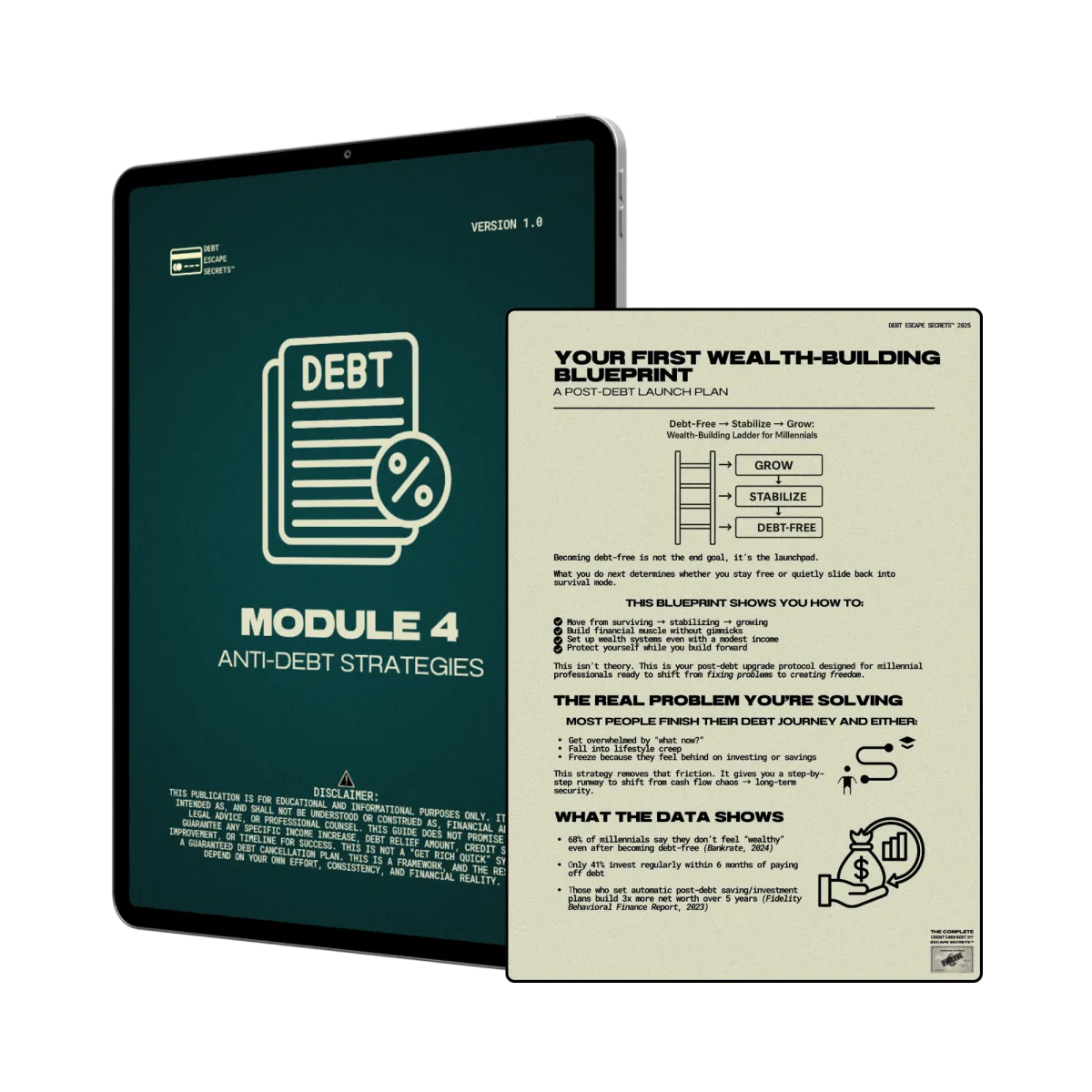

MODULE 4:

Anti-Debt Strategies

You put guardrails in place that prevent old patterns from returning, so you don’t undo your progress during stressful or chaotic moments.

You learn simple, repeatable strategies that block the common debt traps most people fall into — making relapse far less likely.

You gain a long-term sense of stability because your financial life becomes protected by systems instead of willpower.

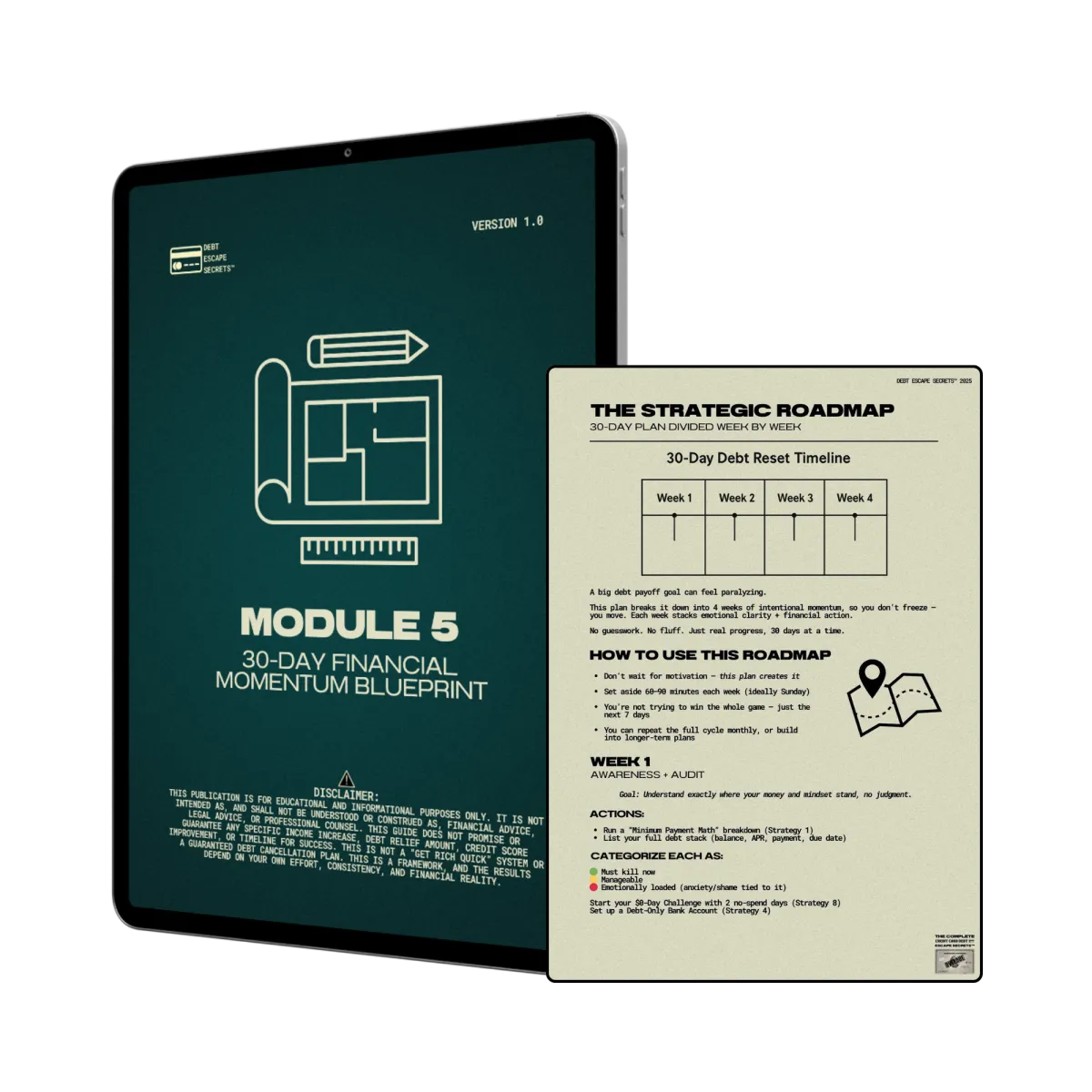

MODULE 5:

30-Day Financial Momentum Blueprint

You get a structured 30-day plan that removes confusion and decision fatigue, so taking action becomes effortless.

You build quick wins that stack into real momentum, giving you the motivation and proof you’ve been needing.

You finally stop stalling or restarting because every day has a clear purpose — turning progress into a habit instead of a struggle.

MODULE 6:

Payoff Automation System

You eliminate the daily mental load of managing payments because your system takes care of the hard work for you.

You stay consistent without relying on discipline or memory — automation keeps you on track even on your busiest or most stressful days.

You experience long-term stability since your money is organized, predictable, and protected from mistakes, forgotten deadlines, or emotional decision-making.

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

You'll Also Receive These

4 FREE BONUSES As Well:

BONUS #1 (WORTH $67)

The 72-Hour Debt Control Protocol™

This alone would be worth $97 because it gives you a step-by-step protocol to stop financial panic within hours, not weeks — something most people desperately need but never know how to do on their own.

Most people would pay $67 just for this because it shows you exactly what to cut, what to freeze, and what to prioritize the moment life hits you — removing all the guesswork during high-stress moments.

Others charge $47 for something similar because it acts like a financial “shock absorber,” preventing debt spikes, late fees, and spirals that could set you back months.

BONUS #2 (WORTH $47)

The Shame-To-Stability Shift™

This alone would be worth $67 because it teaches you how to shut down the emotional spirals that trigger overspending, avoidance, and self-sabotage — the root behaviors that keep people stuck in debt for years.

Most people would pay $47 just for this because it gives them fast emotional relief tools they can use anytime money anxiety hits, helping them stay grounded and in control instead of spiraling.

Others charge $39 for something similar because learning how to regulate your emotions around money instantly increases follow-through, consistency, and long-term financial stability.

BONUS #3 (WORTH $27)

Spending Triggers Workbook™

This alone would be worth $47 because it reveals the exact moments, moods, and patterns that cause your overspending — giving you instant clarity on behaviors you’ve never been able to explain or control.

Most people would pay $27 just for this because it helps them catch emotional triggers before they turn into purchases, saving them from the guilt, setbacks, and “why did I buy that?” frustration.

Others charge $19 for something similar because reprogramming spending habits removes one of the biggest obstacles to staying debt-free long term.

BONUS #4 (WORTH $37)

NeuroReset Audio Soundscapes™

This alone would be worth $57 because it gives you an immediate way to calm your nervous system — letting you think clearly, avoid panic spending, and reset your emotional state within minutes.

Most people would pay $37 just for this because it helps them stay centered during stressful financial moments, preventing emotional decisions that lead to more debt.

Others charge $27 for something similar because soothing your mind directly improves your financial discipline, follow-through, and ability to stay consistent.

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

This'll Be The Safest Financial Decision You'll Ever Make

THIS YEAR.

This'll Be The Safest Financial Decision

You'll Ever Make THIS YEAR.

This'll Be The Safest Financial Decision You'll Ever Make

THIS YEAR.

You’re probably asking yourself: “Okay Matthew… how much is this going to cost me?”

Here’s the truth:

💳 Debt counsellors? Charge you to “manage” payments but keep you stuck.

💳 Bank repayment schemes? Lower bills now, cost more interest later.

💳 Money lenders? Profit twice: ONCE when you borrow, AGAIN when you repay.

I’m not here to profit off your pain like the banks do. I’m here to give you the escape plan they don’t want you to have.

So you won’t invest $197.

You won’t even invest $97.

Today, It's Just $37.

One-Time. Lifetime Access.

That's less than what the banks skim off you in interest every week.

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

Here's Everything You'll Get

When You Invest Today:

The Complete Credit Card Debt Escape Secrets™

(Worth $97)

The 72-Hour Debt Control Protocol™

(Worth $67)

The Shame-To-Stability Shift™

(Worth $47)

Spending Triggers Workbook™

(Worth $27)

NeuroReset Audio Soundscapes™

(Worth $37)

$275 Worth Of Debt-Freedom Tools

Yours For Just $37 Today! (-85%)

You're Saving $238 Today.

Here's My '7-Day No Excuses'

100% Money Back Guarantee.

Here’s the deal: If you go through the playbook, try even one of the strategies, and you don’t feel like you’re closer to escaping debt than the banks are to trapping you?

I’ll give you every dollar back. No questions asked. Just email [email protected] and a refund will be processed back within 48 hours.

In other words:

If it doesn’t work, you get your money back.

If it does, it’ll be the best $37 you’ve ever invested.

Either way, you risk nothing. But If you walk away, the only ones who win are THE BANKS.

Sound fair enough?

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

You Got 2 Paths:

One That Keeps You In Debt And One That Sets You Free.

PATH #1:

You close this page, keep paying “minimums,” and watch the banks quietly drain you for the next 10, 15, even 20 years. You’ll keep living in survival mode, juggling bills, dodging collectors, and losing sleep while their profits climb.

PATH #2:

You grab The Complete Credit Card Debt Escape Secrets™ today for just $37. You take the exact same steps I used to wipe out $9,200 in debt, save $4,000 in interest, and finally breathe debt-free for the first time in years.

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

This $37 Offer Won't Last.

But Your Debt Will.

Every day you wait, the banks are skimming more money off you.

That’s:

👉 $5–$10 a day in interest fees.

👉 $150+ a month gone straight into their pockets.

👉 Thousands more if you sit on this for another year.

So let’s be real: the cost of waiting is always higher than the cost of acting.

This playbook isn’t staying at $37 forever. I priced it low because I wanted to test it with people like you first.

Once it’s proven through my playbook's increased popularity, and more testimonials and reviews, the price goes up to at least $97.

Act now, before another week, or even another day of “minimum payments” slips by.

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

Frequently Asked

Questions:

"Who Is This For?"

This system was created primarily for Millennials who feel like they’re working hard, earning decently, yet still can’t seem to escape the constant pressure of credit card payments and financial stress. It’s for those who want to break the paycheck-to-paycheck cycle, finally see their balances go down instead of up, and rebuild confidence with money without living in restriction or guilt.

Although it was built around the financial realities of Millennials, the principles inside this system work for anyone—whether you’re a Gen Z adult just starting out, a Gen X parent managing family expenses, or even a retiree trying to regain control. The strategies are universal because they focus on timeless money psychology and simple structures that can work for any income level or age.

"I Have More Than $10k In Debt. Will It Still Work For Me?"

Absolutely. The strategies inside this playbook are built to work for any amount of credit card debt — whether you owe $3,000 or $30,000. The difference lies in the timeline, not the effectiveness. If you’re carrying more than $10,000 in debt, your journey will naturally take a bit longer than the average 6–12 month range. But the same systems still apply — you’ll just need more consistency, discipline, and urgency than the average person starting under $10K.

That said, if you’re determined to beat that timeline, it’s absolutely possible. It just requires going all-in — tightening your system, sticking to every step of the framework, and maintaining the intensity most people lose after the first few weeks. Think of it like training for a marathon: the process doesn’t change, but your pace and effort determine how quickly you cross the finish line. If you can commit fully, stay consistent, and track every win, you can move faster than most people ever thought possible — no matter how high your balance is.

"6-12 Months Is Too Good To Be True."

It sounds fast — but only if you keep doing what everyone else does. The truth is, the 6–12 month window isn’t about luck, it’s about frequency. Most people in the $10K range only touch their finances once a month, so of course it takes years. When you follow this system, you’ll act weekly — negotiating interest, reallocating freed-up cash, and locking your spending patterns. That’s how progress compounds.

This isn’t some miracle. It’s what happens when you run the right system with more precision and consistency than the average person drowning in debt. If you follow it like I did — and refuse to skip a week — 6–12 months isn’t a fantasy. It’s exactly what consistent action looks like when you finally stop waiting for “next month” to fix the problem.

"How Fast Can I See Results?'

Faster than you think. Everyone’s debt is different, but the moment you start, you’ll stop guessing and know exactly what to do.

You’ll feel relief quickly often within the first week because you finally have a clear plan instead of stress and guesswork.

"Is This Beginner Friendly?"

Yes. It was built for beginners. You don’t need to be a financial expert or understand complicated formulas, spreadsheets, or jargon. If you’ve struggled with other systems, this was made for you.

The entire guide is plain language, step-by-step, with clear actions you can take right away. Nothing complicated or overwhelming. Most people start busy, stressed, and from scratch.

That’s why this system gives you simple wins fast. No confusing math. No guesswork. No perfection. Just clear steps that fit real life.

"What If This Doesn't Work For Me?"

That’s exactly why I built it for beginners. You don’t need financial expertise or complicated spreadsheets. The guide is plain language, step-by-step, with actions you can take right away.

And if you try it and still feel stuck? You’re protected by a 7-day money-back guarantee. No risk, no guesswork. Just clear steps that fit real for real life:

Messy schedules, limited income, decision fatigue, shame, stress. That’s why it works.

"I Can Figure This Out On My Own."

You could. You’re smart and capable, and with enough trial and error you’d find some answers. But it would cost you stress, wasted time, and expensive mistakes.

This system is a shortcut — a proven path built from real experience. Smart people don’t reinvent solutions. They use what works. That’s what this playbook gives you: the fastest way forward without years of frustration.

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

Your Finances Will Change In

6-12 MONTHS From Now.

Picture opening your banking app tomorrow morning. Instead of that heavy knot in your chest, you feel calm because your balance is finally moving in the right direction.

You’re not sitting there calculating which card has a little room left for groceries. You’re not holding your breath when the phone rings, hoping it isn’t a collector on the other end.

When you go out with friends, you can actually enjoy the moment — no quiet panic about whether dinner will push you deeper into debt.

And imagine the pride of sitting with your family and telling them, honestly, “I’ve got it under control,” without shame or excuses.

This isn’t about being rich. It’s about peace of mind, freedom from stress, and finally feeling like your life belongs to you again.

That’s what debt freedom feels like — and that’s exactly where The Complete Credit Card Debt Escape Secrets™ is designed to take you in the next 6–12 months.

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

You're Finally Exposed

To The Bank's Dirty Secrets.

You’ve seen how the banks profit by keeping you trapped.

You’ve seen why budgeting apps, side hustles, and repayment schemes only rearrange the pain.

And you’ve seen how this playbook was built from the exact steps I used to pay off $9,200 across 5 cards in 19 months — and save $4,000 in interest the banks will never get back.

Here’s what you’re getting today:

👉 The Complete Credit Card Debt Escape Secrets™ — 6 modules packed with tactical payoff strategies, cashflow boosters, automation systems, and mindset resets designed to get you out of debt in 6–12 months.

👉 BONUS #1: The 72-Hour Debt Control Protocol™ — Your emergency debt-control system for financial chaos and sudden income drops, built to stabilize your finances fast.

👉 BONUS #2: The Shame-To-Stability Shift™ —

The emotional recovery protocol that eliminates guilt-driven spending and restores calm, control, and clarity around money.

👉 BONUS #3: Spending Triggers Workbook™ — A focused behavioral tool that helps you spot and reprogram emotional spending habits before they spiral.

👉 BONUS #4: NeuroReset Audio Soundscapes™ — 3 hours of therapeutic soundscapes that flip you from stress to clarity mode so you can make better money decisions with a clear head.

👉 7-Day No-Excuses Guarantee — Try it. If you don’t feel closer to debt freedom, you get every penny back. No risk. No excuses.

And all of it is yours today for just

$37 one-time. Lifetime access.

That’s less than what the banks quietly skim from you in interest this week alone.

So here's your choice:

Keep paying them for the next 20 years...

Or invest in yourself today with the escape plan they don't want you to have.

That being said, I'll see you at the top.

Yours Sincerely,

Matthew Williams

Founder Of Debt Escape Secrets™

7-Day Money Back Guarantee

100% Secure 256-Bit Security Encryption

Here's Everything You'll Get

When You Invest Today:

The Complete Credit Card Debt Escape Secrets™

(Worth $97)

The 72-Hour Debt Control Protocol™

(Worth $67)

The Shame-To-Stability Shift™

(Worth $47)

Spending Triggers Workbook™

(Worth $27)

NeuroReset Audio Soundscapes™

(Worth $37)

$275 Worth Of Debt-Freedom Tools

Yours For Just $37 Today! (-85%)

You're Saving $238 Today.

P.S...

Every day you wait, the banks skim another $5–$10 in interest — more than this entire playbook package costs. Don’t hand them another dollar.

You don't want them to profit of your pain right?

Then take back control today for just $37 — less than the price of dinner & drinks, and completely risk-free.

All Rights Reserved 2025 | Debt Escape Secrets™

Refund Policy | Terms & Conditions

LEGAL DISCLAIMER:

This publication is for educational and informational purposes only. It is not intended as, and shall not be understood or construed as, financial advice, legal advice, or professional counsel. While the author has made every effort to ensure the accuracy of the information, no guarantees are made regarding results or outcomes. You are solely responsible for your own financial decisions, and you should always consult with a licensed financial advisor, attorney, or certified credit counselor before taking action on any financial matter. By reading this guide, you accept full responsibility for your actions and agree that the author and publisher are not liable for any losses or damages resulting from your use of this material. The strategies, tools, and case studies in this book are provided to help you gain insight and take back control of your finances in a crisis. However, individual results will always vary. This guide does not promise or guarantee any specific income increase, debt relief amount, credit score improvement, or timeline for success. This is not a “get rich quick” system or a guaranteed debt cancellation plan. This is a framework, And the results depend on your own effort, consistency, and financial reality. Financial stress can deeply affect your mental and emotional health. This guide may reference anxiety, burnout, shame, or crisis-related emotions. Please note: this book is not a substitute for therapy, counseling, or licensed mental health treatment. If you're in a mental health emergency or experiencing signs of depression, hopelessness, or panic attacks, please seek professional help immediately. Your wellbeing matters more than any strategy in these digital products.